Day: January 30, 2024

-

Egyptian AI-Powered Logistics Startup Roboost Secures $3 Million Investment for MENA Expansion

Roboost, a pioneering AI-powered logistics startup, has secured a $3 million investment round.

-

South African Developer Marketplace OfferZen Secures $4.3 Million Funding For Growth

OfferZen, a South African developer hiring marketplace, has secured $4.3 million in funding from Invenfin and AI Capital. This comes alongside a strategic shift in their business model and a change in leadership.

-

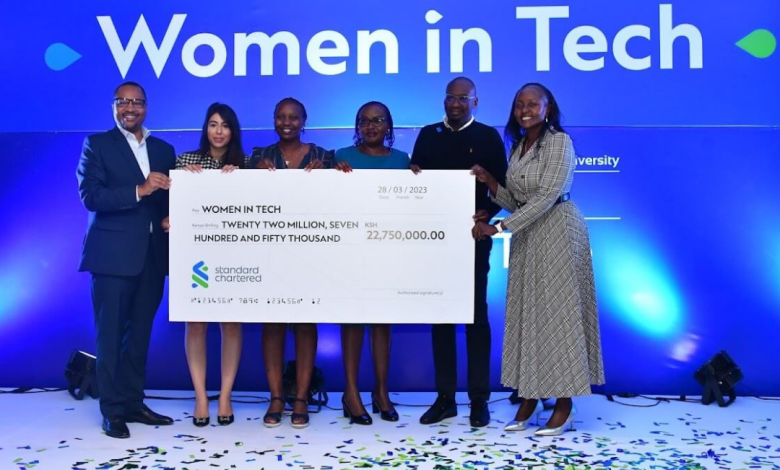

Village Capital and Standard Chartered Partner to Invest in Women-Led Startups in Africa

In a pivotal move to address the gender funding gap in Africa’s entrepreneurial landscape, Village Capital and Standard Chartered Bank have joined forces to launch a pilot financing facility.

-

Core DAO Launches $5 Million African Innovation Fund to Support Web3 Projects in Africa

Core DAO has announced the launch of the African Innovation Fund, a groundbreaking initiative to provide resources and networks to support local Web3 builders and projects across the African continent.