Day: June 29, 2024

-

Vantage Capital Pumps $47.5 Million into Expansion of Kenyan Business Park Two Rivers

Two Rivers International & Innovation Centre (TRIFIC SEZ), a unique services-oriented business park within Nairobi’s diplomatic zone, has secured a $47.5 million investment from Vantage Capital, Africa’s largest mezzanine fund manager.

-

EBRD Commits $40 Million to Boost Mid-Sized Businesses in North Africa

The European Bank for Reconstruction and Development (EBRD) is injecting up to $40 million into SPE Capital’s newly launched SPE PEF III fund.

-

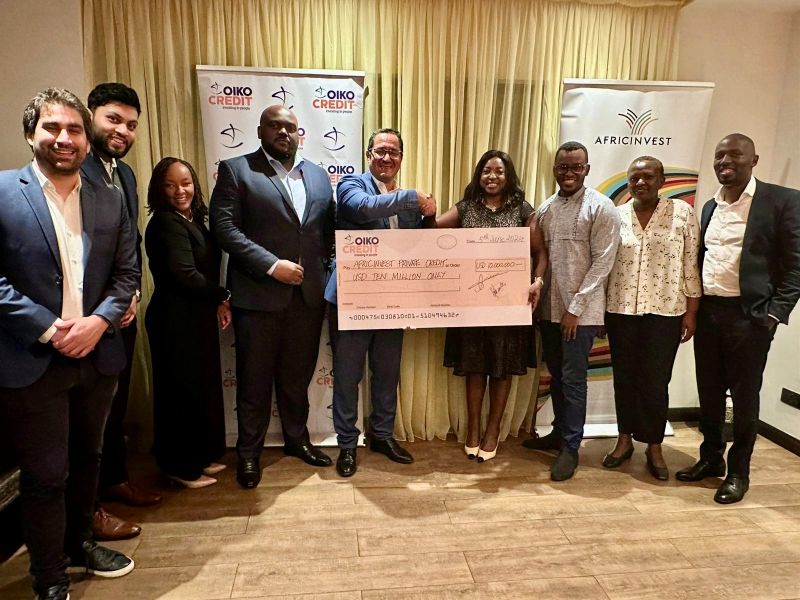

Oikocredit Injects $10 Million to Boost African SMEs in Partnership with AfricInvest

Social impact investor Oikocredit has provided a first-time loan of $10 million to AfricInvest Private Credit (APC) to empower small and medium-sized businesses (SMEs) across Africa.

-

SA’s Mama Money Partners Access Bank, Paymentology to Launch WhatsApp-Based Bank Card

South African fintech startup Mama Money has partnered with global banking leader Access Bank and card issuing company Paymentology to launch a first-of-its-kind bank card service powered entirely through WhatsApp.