Day: July 17, 2024

-

Nael Hailemariam: The Ethiopian Fintech Entrepreneur Simplifying Financial Transactions for Businesses

Nael Hailemariam is an Ethiopian entrepreneur dedicated to revolutionizing digital payments in Africa.

-

Access Bank Secures $30 Million From Swedfund to Support SMEs in Nigeria

Access Bank Plc, Nigeria’s largest bank by assets, received a $30 million loan from Swedfund, a Swedish development finance institution, to support small and medium-sized enterprises (SMEs) in the country.

-

South African Fintech TurnStay Secures Funding to Expand Travel Payment Solutions Across Africa

South African travel technology company TurnStay has secured a $300,000 funding round from DFS Lab and Digital Currency Group (DCG), both headquartered in the United States.

-

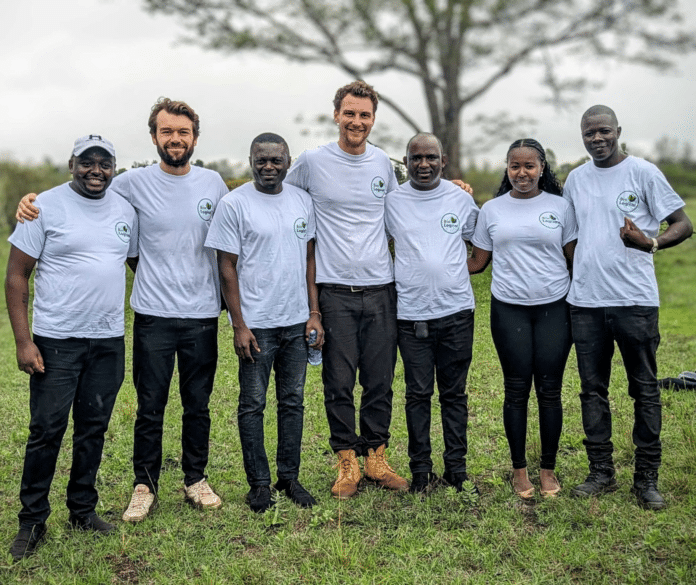

Kenyan Climate Startup Bio-Logical Secures $1.3 Million to Expand Biochar Facility

Kenyan climate tech startup Bio-Logical has secured $1.3 million in funding to boost its Mount Kenya biochar production facility.