New Investments

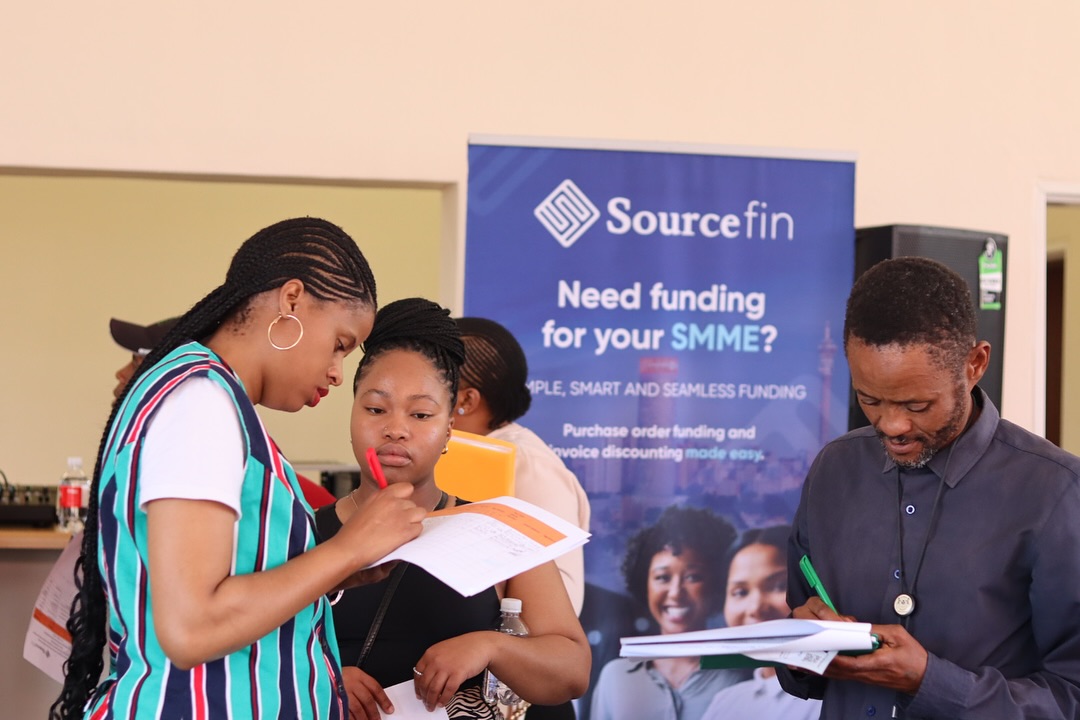

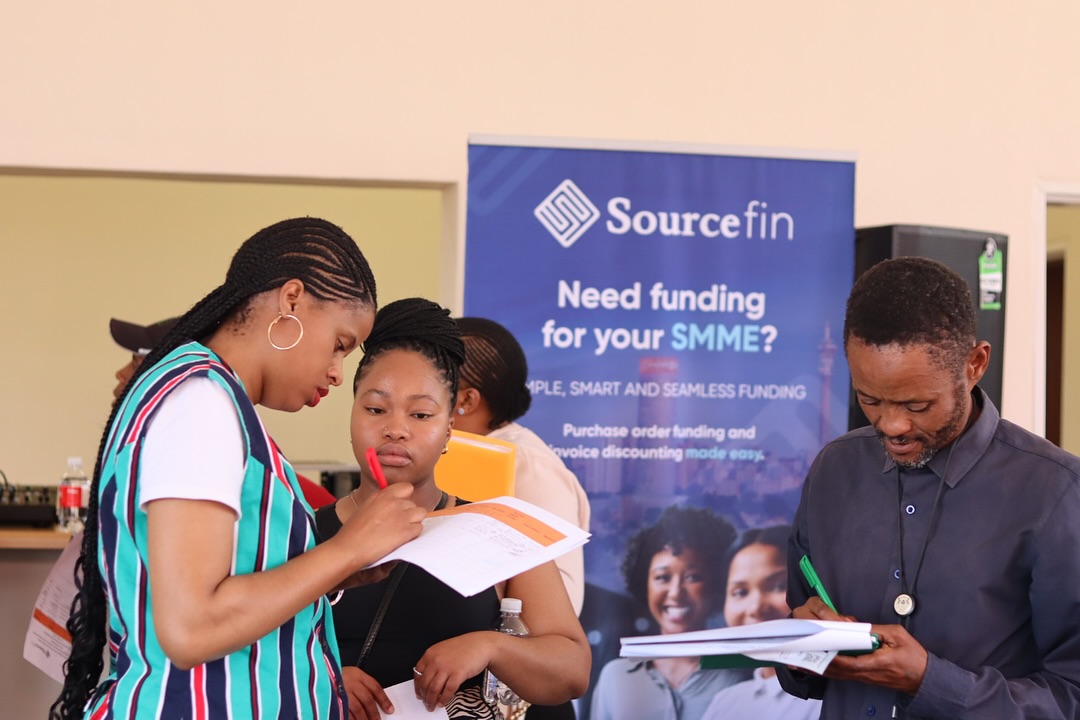

Sourcefin Secures $8.2 Million Investment to Empower South African SMMEs

South African fintech and alternative funding provider Sourcefin has secured $8.2 million from Futuregrowth Asset Management.

The investment, sourced through Futuregrowth’s High Growth Developmental Equity Fund (HGDEF), reinforces Sourcefin’s mission to address the financing needs of small and medium-sized enterprises (SMMEs) in the country.

Established in 2020, Sourcefin focuses on bridging the critical financing gap for SMMEs, enabling them to manage working capital constraints and complete public and private sector purchase orders.

The company’s approach integrates technology with procurement and project management expertise, making it a leader in supporting tender fulfilment.

The new funding will allow Sourcefin to scale its investment significantly into South Africa’s SMME sector.

Co-founder, Director, and CEO Joshua Kadish highlighted the importance of the sector for economic growth, stating:

“There is no doubt about the massive impact that well-supported SMMEs can have on our country. With the support from Futuregrowth, Sourcefin’s ability to scale investment into the SMME sector significantly increases, and it is our commitment that all R150 million will be deployed as a reinvestment into the backbone of our economy.”

Amrish Narrandes, Futuregrowth’s head of private equity and venture capital, emphasized the strategic value of the investment, saying:

“The SMME sector is vital for South Africa’s economic growth, yet traditional financing solutions often fail to meet their unique needs, particularly in government-issued orders. Sourcefin’s technology-first approach, coupled with their expertise, has created a truly transformative solution. Their proven ability to support tender fulfilment while maintaining strong financial performance made this a compelling investment opportunity.”

Futuregrowth’s HGDEF has a strong track record of supporting high-growth businesses, including hearX, Yoco, Pineapple, Retail Capital, Ozow, and Cash Connect.

Related Articles

Register Now

Empower Africa Times Newsletter

Share :

“We are delighted to partner with ISA to support the development of solar energy in Africa,” said Alain Ebobissé, CEO of Africa50. “This partnership will help to accelerate the deployment of solar energy in Africa and improve the lives of millions of Africans,” he added.

You may also like…

Candi Solar Raises $24 Million to Expand Clean Energy Projects in India and South Africa

Candi Solar, a company that supplies clean energy to businesses in developing countries, has raised $24 million in new funding from its current backers.

ALCB Fund Secures $45 Million from FMO to Expand Access to Local Currency Finance in Africa

The African Local Currency Bond Fund (ALCB Fund), managed by Cygnum Capital, has received a $45 million investment from Dutch development bank FMO, with co-funding from its asset management arm, FMO Investment Management (FMO IM).

Enko Capital Secures $30 Million from PIC to Grow Private Credit Access Across Africa

South Africa’s state-owned asset manager, the Public Investment Corporation (PIC), has committed $30 million to a private-credit vehicle run by the Africa-focused alternative investment firm Enko Capital.