New Investments

Nigerian Fintech Raenest Raises $11M Series A Funding to Expand Cross-Border Payment Solutions

Raenest, a global multi-currency accounts platform serving individuals and businesses across Africa, has successfully raised $11 million in Series A funding.

The funding round was led by QED Investors, with additional support from Norrsken22 and continued investment from Ventures Platform, P1 Ventures, and Seedstars.

This latest equity-based investment brings Raenest’s total venture funding to $14.3 million.

Raenest’s retail product, Geegpay, provides freelancers with virtual accounts in USD, GBP, and EUR, allowing them to receive payments, manage multi-currency wallets, and perform currency conversions.

Additionally, users have access to both virtual and physical debit cards for seamless international transactions.

In March 2023, the company expanded its services to businesses under the Raenest for Business brand, streamlining international remittance processes for enterprises operating in Africa.

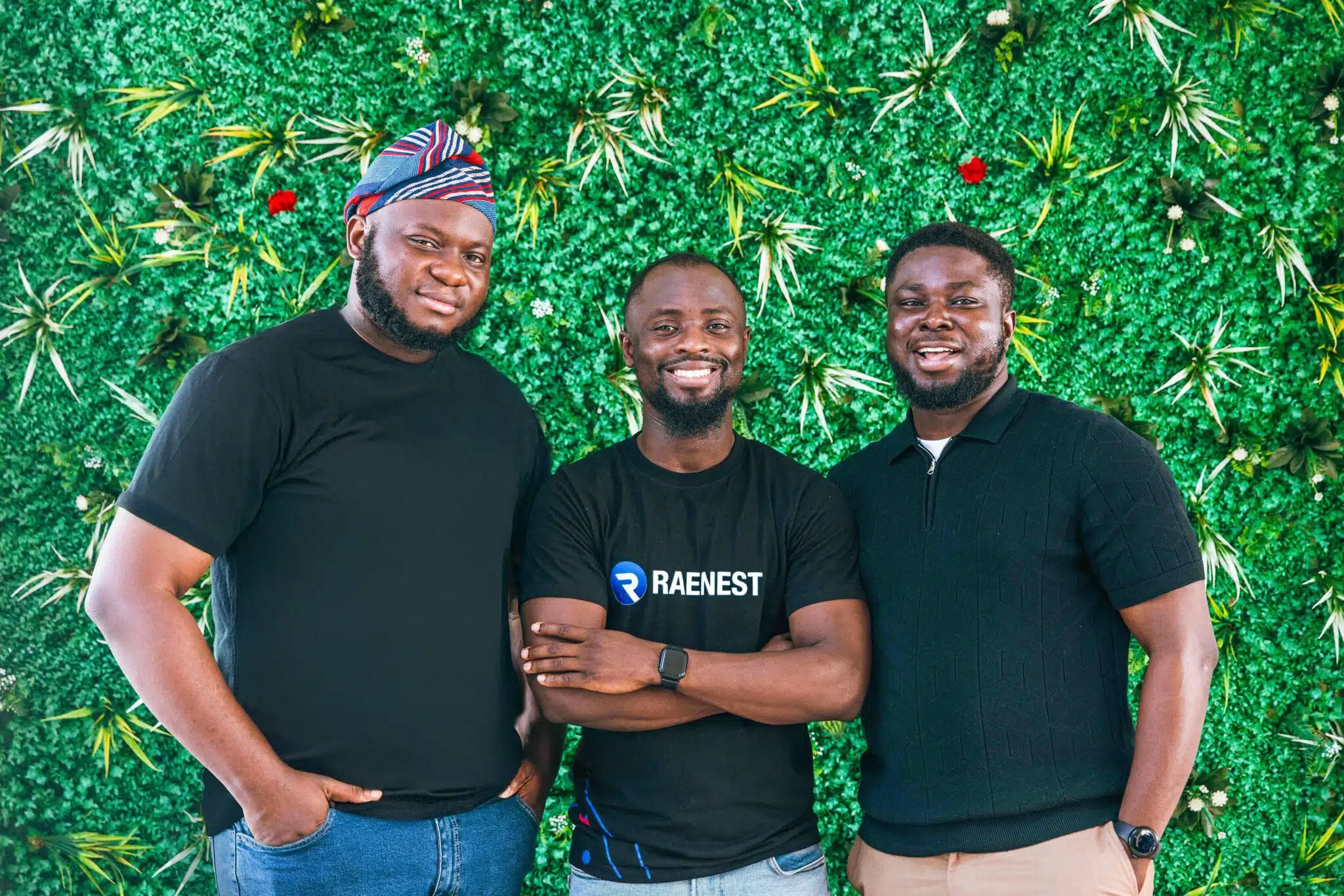

Founded in 2022 by Victor Alade, Sodruldeen Mustapha, and Richard Oyome, Raenest initially launched as an Employer of Record (EOR) service to help foreign companies pay African employees while ensuring compliance with local regulations.

However, the co-founders quickly identified a more pressing challenge: individuals struggling to receive payments efficiently.

“A U.S. company might not be affected by a five-day delay in payments, but for someone in Nigeria or Kenya, such delays can significantly impact their finances, especially when converting to local currency,” said CEO Victor Alade.

Since its inception, Raenest has processed over $1 billion in payments, marking a 160% growth over two years.

The platform currently supports more than 700,000 freelancers who receive payments from platforms such as Upwork, Fiverr, and Gusto.

Additionally, over 300 businesses, including Moniepoint, Helium Health, Fez Delivery, and Matta, use Raenest for cross-border transactions.

Commenting on the investment, Gbenga Ajayi, Partner and Head of Africa and the Middle East at QED Investors, stated:

“At QED, we’re excited to support Raenest as they revolutionize cross-border banking for Africans. Their commitment to financial inclusion and seamless user experience makes them a transformative player in the fintech space.”

Lexi Novitske, General Partner at Norrsken22, also highlighted the importance of Raenest’s mission, noting:

“Africa’s gig economy is expanding by 20% annually, yet cross-border payment challenges remain. Raenest is addressing a critical gap, ensuring freelancers and businesses can efficiently receive and manage their funds.”

Related Articles

Register Now

Empower Africa Times Newsletter

Share :

“We are delighted to partner with ISA to support the development of solar energy in Africa,” said Alain Ebobissé, CEO of Africa50. “This partnership will help to accelerate the deployment of solar energy in Africa and improve the lives of millions of Africans,” he added.

You may also like…

IFC Proposes $7 Million Investment in Moroccan Proptech Startup Yakeey

The International Finance Corporation (IFC), the private-sector arm of the World Bank Group, has proposed plans to invest up to US $7 million in the Moroccan proptech startup Yakeey.

LAfricaMobile Secures $4.6 Million in Series A Funding to Expand Cloud Communication Platform in Africa

LAfricaMobile, a leading provider of cloud communication and mobile marketing solutions, has secured €4.3 million in Series A funding.

Kenyan-Based VC Firm Uncap Launches $33 Million Fund to Support African SMEs

Uncap, a venture capital firm operating in Munich and Nairobi, has announced the launch of a $33 million fund aimed at supporting the growth of small and medium-sized enterprises (SMEs) across Africa.