Tag: Digital Transformation

-

Nigeria’s Intron Health Secures $1.6 Million to Revolutionize African Healthcare with AI

Intron Health, a pioneering Nigerian health-tech startup, has successfully raised $1.6 million in a pre-seed funding round led by Microtraction.

-

Village Capital Invests $850,000 in Kenyan and Nigerian Agritech Startups

Village Capital, a global nonprofit investor in early-stage companies, has announced investments in Kenyan startup Aquarech and Nigerian startup Coamana.

-

One Acre Fund Secures $1.4 Million Investment From Impact Bridge Asset Management to Support African Farmers

One Acre Fund, a social enterprise empowering smallholder farmers in East Africa, has secured a $1.4 million investment from Impact Bridge Asset Management.

-

Aruwa Capital Makes Follow-On Investment in Hibiscus Exporter AgroEknor

Aruwa Capital Management, a leading early-stage growth equity fund, has announced a follow-on investment in AgroEknor, a prominent hibiscus flower exporter and wellness brand.

-

FMO Injects $10 Million into REGMIFA to Boost Sub-Saharan African SMEs

Dutch development finance institution FMO has announced a $10 million investment in the Regional MSME Investment Fund for Sub-Saharan Africa (REGMIFA).

-

Nigerian Startups Sycamore, Kunda Kids and PaveHQ Feted at NSIA Innovation Prize

Fintech startup, Sycamore, has emerged as the grand winner of the second edition of the Nigeria Sovereign Investment Authority (NSIA) Prize for Innovation, securing a $100,000 prize.

-

South African Clean-Tech Startup Plentify Secures Oversubscribed Funding to Expand Smart Energy Solutions

South African climate-tech startup, Plentify, has successfully concluded an oversubscribed funding round, securing investment from prominent African and North American venture capitalists.

-

MNT-Halan Raises $157.5 Million Months After Becoming Egypt’s First Unicorn

Egyptian fintech company MNT-Halan has successfully raised $157.5 million in new funding to accelerate its expansion beyond its home market.

-

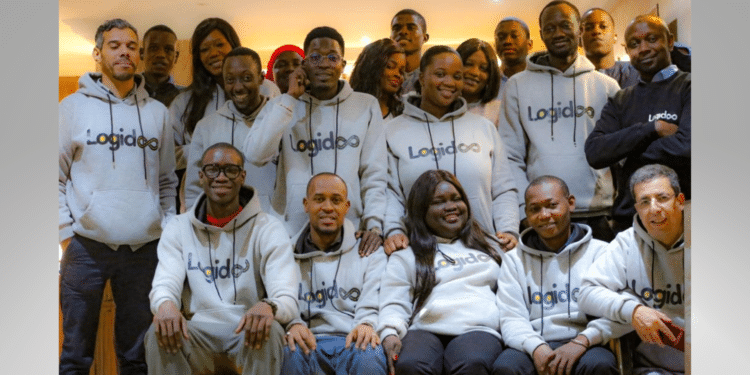

Logidoo Secures Grant to Revolutionize African Logistics with AI

Logidoo, a Pan-African logistics startup, has received a $50,000 grant from the International Development Research Centre (IDRC).