New Investments

SPE Capital Partners Invests $35 Million in Morocco’s Dislog Group

SPE Capital Partners, through its AIF I Fund, has invested MAD 350 million (approximately $35 million) in Moroccan consumer goods company Dislog Group.

The investment, approved by Morocco’s competition authority, will be supplemented by an additional MAD 100 million ($10 million) from an international financial institution, bringing the total funding to MAD 450 million (around $45 million).

Nabil Triki, Managing Partner and CEO of SPE Capital, expressed enthusiasm for the partnership, saying:

“We are pleased to invest alongside our partner in Dislog Group. Having been shareholders of H&S between 2019 and 2021, we are delighted to see the group’s progress and growth in recent years.”

“We aim to grow together with the goal of successfully achieving an IPO on the Casablanca Stock Exchange within the next two to three years.”

Moncef Belkhayat, CEO of Dislog Group, highlighted the confidence shown by investors:

“I am delighted to see the level of trust Dislog Group has built with investment funds and international financial institutions. Thanks to the efforts of its management and teams in enhancing its attractiveness, Dislog Group continues to strengthen its shareholder base and align its governance with the highest international standards.”

“I warmly welcome the SPE Capital team, with whom we share a close relationship as they were our partners and part of our board members between 2019 and 2021.”

Dislog Group received legal counsel from Hilmi Law Firm, while SPE Capital was advised by DLA Piper, Deloitte FA, and IBIS, which served as its ESG advisor.

This investment marks a significant milestone in Dislog Group’s trajectory as it works toward further growth and a potential listing on the Casablanca Stock Exchange.

Related Articles

Register Now

Empower Africa Times Newsletter

Share :

“We are delighted to partner with ISA to support the development of solar energy in Africa,” said Alain Ebobissé, CEO of Africa50. “This partnership will help to accelerate the deployment of solar energy in Africa and improve the lives of millions of Africans,” he added.

You may also like…

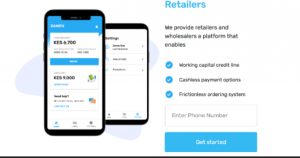

Kenyan fintech Zanifu raises $11.2 million to scale its inventory financing offering

Zanifu, a Kenyan fintech company that provides inventory financing to micro, small, and medium-sized businesses (MSMEs), has raised $11.2 million in debt-equity funding in a pre-Series A round.

VC Firm HAVAÍC Secures $15 Million for Third African Innovation Fund

Venture Capital firm HAVAÍC has successfully raised $15 million in commitments for its third African Innovation Fund, marking the first close of the $50 million fund.

Incofin Backs East African Food Enterprises to Boost Nutrition and Food Security

Incofin Investment Management, through the Nutritious Food Financing Facility (N3F) and in partnership with the Global Alliance for Improved Nutrition (GAIN), has invested in three food companies in East Africa: Soy Afric in Kenya, and Mkuza Chicks and Rainbow Haulage in Tanzania, to boost nutrition and food security in the region.