Tanzania-based fintech firm Kuunda secures $7.5 million to expand into Egypt and MENA

B2B fintech company Kuunda—headquartered in the UK but focused on Tanzania and broader African markets—has raised US$7.5 million in a pre-Series A funding round.

The Empower Africa Business Platform is Now Live !!!

Sahel Capital has secured $29 million in initial commitments for its newest agribusiness investment vehicle, the Sahel Capital Agribusiness Fund II (SCAF II), marking the first fundraising milestone for the firm’s latest growth equity effort.

The closing occurred in late 2025 and was led by KfW Development Bank, with significant participation from a United States–based family office.

The firm aims to raise a total of $75 million for SCAF II within the next year, positioning the fund to channel capital into expanding agribusiness enterprises across key West African markets.

The fund is set up with dual domiciliation in Mauritius and Nigeria and follows Sahel Capital’s earlier vehicle, the Fund for Agricultural Finance in Nigeria (FAFIN).

Like its predecessors, SCAF II uses a blended finance structure that includes a first-loss tranche to help mitigate investor risk and attract diverse capital.

SCAF II will deploy growth equity investments across agribusiness value chains in Nigeria, Ghana, Côte d’Ivoire and Senegal, sectors viewed as central to strengthening regional food systems and economic resilience.

Investment themes include enhancing food security, promoting climate-resilient business models, supporting import substitution, and improving efficiencies across agricultural value chains — all priorities in a region where agriculture remains a vital driver of employment and livelihoods.

Mezuo Nwuneli, Managing Partner at Sahel Capital, characterized the first close as validation of investor trust in the firm’s strategy and its ability to source and execute impactful transactions.

He noted that Sahel Capital’s pipeline remains strong and aligned with urgent needs in food production and climate adaptation across the region.

“The first close of SCAF II … demonstrates strong investor confidence in our strategy and our ability to originate and execute high-quality transactions,” said Mezuo Nwuneli.

Oliver Van Bergeijk, Head of Division for Equity and Funds at KfW’s Sub-Saharan Africa and Latin America unit, highlighted the shared objective of reinforcing local food systems by connecting agribusinesses with smallholder farmers and building resilient supply chains.

He emphasized KfW’s long-standing partnership with Sahel Capital and its appreciation for the firm’s execution capabilities and impact-oriented investment approach.

“Our partnership with Sahel Capital reflects a shared commitment to strengthening food security through robust domestic supply chains that link agribusinesses with smallholder farmers,” said Oliver Van Bergeijk.

This first closing and the firm’s stated impact goals come amid broader efforts to mobilize private investment into African agribusiness, where capital gaps have historically constrained growth despite agriculture’s contribution to regional GDP and employment.

Sahel Capital’s track record includes managing previous funds focused on agribusiness SMEs, and SCAF II represents its next strategic step in scaling private capital for the sector.

B2B fintech company Kuunda—headquartered in the UK but focused on Tanzania and broader African markets—has raised US$7.5 million in a pre-Series A funding round.

WATT Renewable Corporation, a leading provider of hybrid solar solutions in Nigeria, has secured $13 million in funding from Empower New Energy.

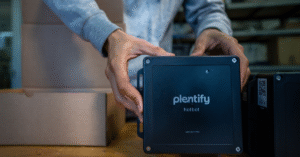

South African climate-technology firm Plentify has successfully closed a Series A funding round, adding new momentum to its mission of smarter home energy management as it sets its sights on international markets.