New Investments

African VC Janngo Capital Closes Second Fund at $78 Million to Back African Entrepreneurs

Janngo Capital, an African venture capital firm, has successfully closed its second fund at $78 million, exceeding its initial goal of $63 million by 20%.

Backed by notable institutions including the African Development Bank Group (AfDB) and the European Investment Bank (EIB), the fund aims to catalyze African entrepreneurship and foster job creation, with a specific focus on opportunities for youth and women.

The firm closed the fund for the first time in 2022 at €26 million, with initial backing from the AfDB and EIB.

Additional support for the final close came from new investors such as the Mastercard Foundation Africa Growth Fund, Tunisia’s ANAVA fund, the endowment fund of Ghana’s Ashesi University, the U.S. International Development Finance Corporation (DFC), and the World Bank’s International Finance Corporation (IFC).

Founded by Fatoumata Bâ, Janngo leverages technology and funding to establish digital ecosystems in high-growth sectors.

It aims to empower African SMEs and provide growth pathways for youth and women in the workforce.

With women-led companies comprising 56% of its portfolio, Janngo is tackling the region’s gender gap within the entrepreneurial landscape.

Notable investments include Nigeria’s Sabi, a B2B eCommerce platform, underscoring the firm’s commitment to supporting female-led ventures.

Bâ has emphasized Janngo’s commitment to impact-driven investment, noting that Africa, while having the highest global rate of female entrepreneurship, receives only a small share of global VC funding.

She highlighted that although venture capital funding in Africa has grown from $150 million a decade ago to around $4 billion to $5 billion today, Africa’s share remains at only 1%-2% of global funding—a figure that does not align with the continent’s population share of 17%.

Bâ remarked, “If we believe tech is critical to economic development in Africa, we should have proportional access to VC.”

Since its inception in 2018, Janngo’s portfolio has included over 30 investment rounds across 21 startups, including Series B follow-on investments.

The firm allocates between €150,000 and €5 million to startups in sectors such as healthcare, logistics, financial services, retail, agritech, mobility, and the creator economy and maintains offices in Abidjan, Mauritius, Tunis, and Paris.

In March 2024, Janngo’s Startup Fund (JCSF) also received a €4 million ($4.3 million) equity investment from Tunisia’s “ANAVA” fund, designated for francophone African startups and female-founded businesses.

Related Articles

Register Now

Empower Africa Times Newsletter

Share :

“We are delighted to partner with ISA to support the development of solar energy in Africa,” said Alain Ebobissé, CEO of Africa50. “This partnership will help to accelerate the deployment of solar energy in Africa and improve the lives of millions of Africans,” he added.

You may also like...

Vantage Capital Invests €14 Million in Moroccan Agriculture Firm SPMS

Vantage Capital, a leading African fund manager, has announced the closing of a €14 million mezzanine investment in Société de Production Maraîchère Samir (SPMS), a Moroccan agricultural company.

Equator Africa Secures Additional $5 Million from IFC to Boost African Climate Tech Innovation

Equator Africa, a venture capital firm, has secured an additional $5 million from the International Finance Corporation (IFC) to support businesses and foster innovation within Africa’s climate tech sector.

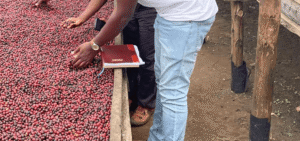

Ugandan Coffee Exporter JKCC Receives $6.5 Million Boost from IDH Farmfit Fund

Uganda’s JKCC General Supplies has secured a $6.5 million loan from the IDH Farmfit Fund to support its operations and expand its reach among local coffee farmers.