New Investments

Kenyan Climate Startup Bio-Logical Secures $1.3 Million to Expand Biochar Facility

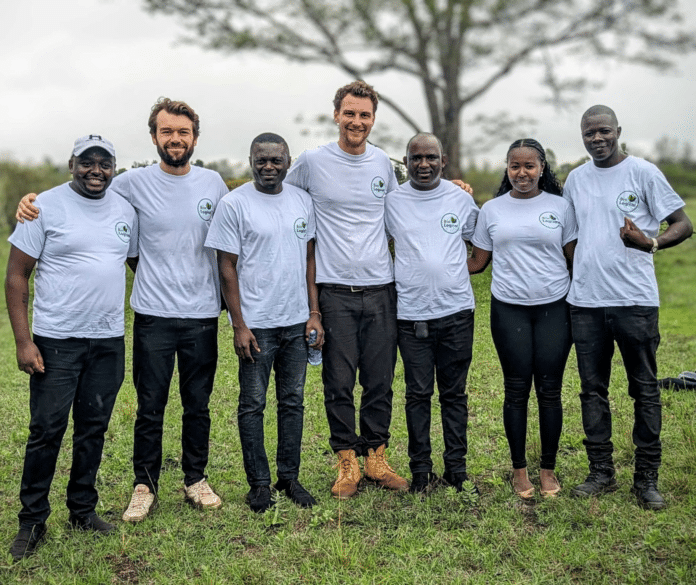

Kenyan climate tech startup Bio-Logical has secured $1.3 million in funding to boost its Mount Kenya biochar production facility.

This expansion aims to improve the livelihoods of smallholder farmers in the country.

The funding round was led by investment firms CrossBoundary and Redshaw Advisors, alongside existing investors including the Steyn Group.

“This funding is crucial for scaling up our operations at Mount Kenya,” said Rory Buckworth, co-CEO of Bio-Logical. “It also allows us to replicate this model for future expansion, with plans to establish three additional sites across Kenya within the next 18 months.”

This investment comes months after Bio-Logical secured $1 million in seed funding to establish its first facility.

The company’s long-term goals include supporting one million smallholder farmers and sequestering one million tons of carbon dioxide annually by 2030.

Bio-Logical’s technology transforms agricultural waste into biochar, a charcoal-like substance that captures carbon and improves soil health.

This process not only benefits the environment but also empowers farmers by providing them with affordable, climate-resilient fertilizer.

“Smallholder farmers are often hit hardest by climate change, despite contributing very little to the problem,” said Philip Hunter, co-CEO of Bio-Logical.

Related Articles

Register Now

Empower Africa Times Newsletter

Share :

“We are delighted to partner with ISA to support the development of solar energy in Africa,” said Alain Ebobissé, CEO of Africa50. “This partnership will help to accelerate the deployment of solar energy in Africa and improve the lives of millions of Africans,” he added.

You may also like...

Swedfund and IFU Invest $44 Million with Sturdee Energy to Advance Renewable Energy in Southern Africa

Swedfund, the Swedish development finance institution, and the Danish Investment Fund for Developing Countries (IFU) have joined forces with Sturdee Energy to drive renewable energy expansion in Southern Africa.

South African Agritech Startup Khula! Secures Investment from PepsiCo Fund to Empower Farmers

Khula, a South African agritech startup dedicated to empowering farmers through a digital platform, has secured an undisclosed investment from a PepsiCo fund.

South African Fintech Float Raises $2.6 Million to Accelerate Expansion

South African financial technology startup Float, a pioneering card-linked instalment provider, has secured US$2.6 million in a fresh funding round.