- EmpowerAfrica

- ,

Did you know that over 525 million people used the internet in Africa in 2019? If current growth trends continue, almost 75% of Africans are expected to come online by 2030.

The Empower Africa Business Platform is Now Live !!!

By: Leah Ngari

In a rapidly evolving world, regulatory bodies often have trouble keeping up with the pace of business and technology innovation – especially when it comes to fintech. To allow for innovation while protecting potential customers, governments across the globe – and across Africa – have designed “regulatory sandboxes.” Read on to learn more about regulatory sandboxes and find out about the regulatory sandbox program in seven African countries.

The financial products and services sector is highly regulated almost everywhere in the world, because governments want to make sure that their citizens’ money is safe and protected. But although financial regulation is critical to protecting customers, it can also hamper innovation by raising the barriers to entry into the sector so high that they keep new players out.

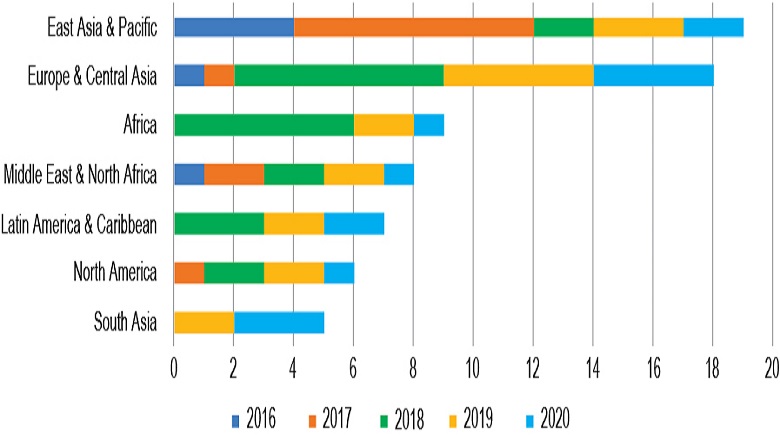

A regulatory sandbox is a controlled environment that allows entrepreneurs, regulators, and other players in the fintech industry to test out new financial products or services without being too constrained by inappropriate regulations. Since its inception in the United Kingdom, the regulatory sandbox has spread all over the world, with Asia and the Pacific regions taking the lead.

Number of Sandboxes by Worldbank Regions. Image from the Worldbank Group

The Worldbank Group has identified key areas that regulatory sandboxes can assist in:

Sierra Leone’s Sandbox Regulatory Framework was launched in 2018. The process was started by the Bank of Sierra Leone with the help of the Financial Sector Deepening Africa (FSDA) and the United Nations Capital Development Fund (UNCDF), as part of the country’s Fintech Initiative. To be eligible to participate in Sierra Leone’s regulatory sandbox, the company must be registered with Sierra Leone, and a Sierra Leonean citizen needs to own at least 10% of the firm. The regulatory sandbox is limited to fintech companies, and has a focus on financial inclusion in the solutions they admit into the program.

Kenya’s regulatory sandbox is under the Capital Markets Authority of Kenya (CMA). It was approved in March 2019 when the CMA started to accept applications for admissions into the regulatory sandbox. Interested companies or individuals are expected to apply to be considered, following a list of requirements outlined in the Regulatory Sandbox Policy Guidance Note. The document outlines the steps needed to apply for the regulatory sandboxes and the eligibility criteria used. For instance, it is only open for companies incorporated in Kenya or those licensed by as securities market regulator in an equivalent jurisdiction.

Once admitted, the company gets a 12-month period to run tests on the product or service, sending interim reports on the progress to the CMA. After the 12-month period, the company may either be granted permission to operate fully in the market or be denied permission based on the findings from their testing period. Before applying for the sandbox, the companies will need to have developed the idea to the level of operational testing according to the former CMA Chief Executive, Mr. Paul Muthaura. The CMA is currently accepting applications to the regulatory sandbox. Currently, at least 4 fintech companies that were admitted into the regulatory sandbox of Kenya.

Rwanda’s government initiative to promote digital financial services led to its adoption of the regulatory sandbox in 2018. Since then, it has embarked on creating guidelines for the regulatory sandbox under the Rwanda Utilities Regulatory Authority (RURA), which are still at the draft stage. The first company to be granted the regulatory sandbox license was the Riha Payment System, a firm that received 6-month approval to test its mobile wallet solution in the Rwandan market.

A company or individual that wishes to apply for this regulatory sandbox needs to have a ground-breaking innovation which is new, or products or services significantly different from products which comply with all relevant regulatory requirements.

Rwanda is also clear on the kind of products or services that would be allowed under these regulations, as the product or service has to be new to the Rwandan market and commercially unavailable in other markets. Academics and researchers who want to test out new technologies may also apply for the regulatory sandbox according to the draft guidelines.

In Mauritius, companies apply for a Regulatory Sandbox License, giving them permission to conduct business where there is no legal framework guiding the activities to be conducted. This License is provided by the Economic Development Board to eligible companies that are willing to invest in innovative projects. Mauritius permits both fin-tech and non-fintech companies to apply for the licenses, providing guidelines for each category. Fintech projects are chosen by the National Regulatory Sandbox Committee, which consists of members of the EDB and the Financial Services Commission (FSC). Licenses in non-fintech are issued by the Board of Investment under the EDB.

Mauritius provides a great example of the impact of regulatory sandboxes on regulators in the area of Peer to Peer (P2P) lending. P2P lending startup Fundkiss wanted to launch a P2P lending service in Mauritius, but there was no legal framework allowing such services, so the company worked with regulators to draft P2P rules. Today, however, P2P companies have graduated from the regulatory sandbox license to more specific Peer to Peer lending regulations. The Mauritian regulatory body has shown great progress in the regulatory environment allowing for innovation and learning from it.

Mozambique is still in its infancy stage when it comes to fintech solutions. In 2018, the Central Bank of Mozambique together with the Financial Sector Deepening Mozambique created the country’s regulatory sandbox. The regulatory sandbox is under the Financial Inclusion Strategy that focuses on achieving financial inclusion in Mozambique. The regulatory sandbox took on the approach of an accelerator, admitting startups to try their ideas in a regulated environment. Some startups they picked include:

Both companies and others in the regulatory sandbox have now been granted the go-ahead to operate in Mozambique. Mukuru currently has a branch in Maputo, Mozambique.

The Bank of Ghana in collaboration with Emtech Service LLC recently launched a regulatory sandbox pilot program. In a press release dated February 2021, the Bank of Ghana announced the launch of its pilot program, mentioning the industries they would focus on. The program is geared towards financial service providers, with preference given to blockchain technology solutions, electronic KYC, remittances and crowdfunding. The regulatory sandbox will be committed to addressing the needs of the unbanked and underserved persons and businesses.

The Central Bank of Nigeria released Nigeria’s regulatory sandbox framework in January 2021. It targets fintech and telecom solutions and will start to approve solution providers who apply for it on a cohort by cohort basis. The framework includes requirements, eligibility criteria and length of time, as well as other guidelines.

Regulatory sandboxes have been able to bridge the gap between the private sector and regulators, enabling an environment where they work together for the development of the country. The growth of regulatory sandboxes across Africa is a testament to the work being done by governments to encourage new technology development on the continent and remove barriers to entry for fintech entrepreneurs.