New Investments

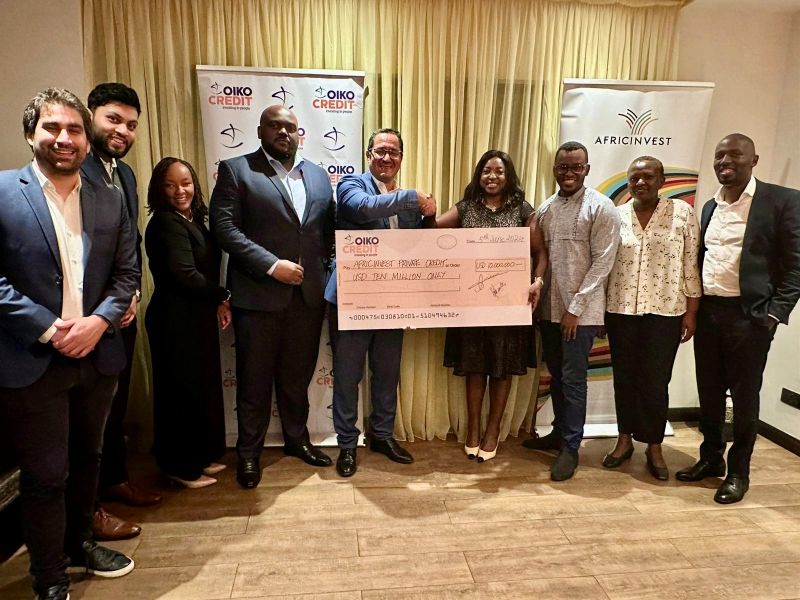

Oikocredit Injects $10 Million to Boost African SMEs in Partnership with AfricInvest

This new partnership will unlock greater access to credit for underserved SMEs.

APC specializes in offering medium to long-term loans, particularly to businesses that struggle to secure financing from traditional institutions due to a lack of collateral.

Oikocredit’s investment will allow APC to expand its lending activities, reaching a wider range of companies in various African countries.

“We’re proud to partner with Oikocredit,” said Kouraiech Belhajali, CEO of APC.

“This funding will enable us to continue supporting underserved businesses in Africa, extending our reach and target market. With this capital injection, we aim to significantly enhance our impact on economic growth, job creation, and financial inclusion.”

Lewis Nyaga, an investment officer at Oikocredit, echoed the sentiment saying:

“We’re thrilled to announce this partnership with AfricInvest and this crucial debt facility designed to strengthen African SMEs.”

Related Articles

Register Now

Empower Africa Times Newsletter

Share :

“We are delighted to partner with ISA to support the development of solar energy in Africa,” said Alain Ebobissé, CEO of Africa50. “This partnership will help to accelerate the deployment of solar energy in Africa and improve the lives of millions of Africans,” he added.

You may also like...

Tanzanian Healthcare Startup Medikea Secures Funding From Catalyst Fund to Tackle Climate-Induced Health Crises

Medikea, a Tanzanian healthcare startup, has secured an investment from the Catalyst Fund to enhance its mission of delivering affordable healthcare services to vulnerable communities.

Egyptian Healthtech Chefaa Secures $5.25 Million for Expansion

Egyptian healthtech startup Chefaa has received a $5.25 million boost in a funding round co-led by Newtown Partners (South Africa) and Global Brain (Japan).

IFC Proposes $6 Million Investment in Flat6Labs’ New African Startup Fund

Flat6Labs, a leading venture capital firm and startup accelerator in the MENA region, is set to receive a proposed equity investment of up to $6 million in its newly launched fund from the International Finance Corporation (IFC).