New Investments

Village Capital and Standard Chartered Partner to Invest in Women-Led Startups in Africa

This initiative targets early-stage, impact-focused startups led by women, aiming to provide much-needed catalytic capital and propel their ventures forward.

Unlocking Opportunities for Impactful Businesses

The partnership recognizes the persistent challenges women entrepreneurs face in accessing funding compared to their male counterparts.

By dedicating resources to women-driven businesses tackling local and global issues, the initiative seeks to create a ripple effect, fostering economic growth and social impact.

Heather Matranga, Vice President of Impact Investments at Village Capital, expressed her enthusiasm:

“We’re thrilled to partner with Standard Chartered and support their vision of empowering women founders. Through this innovative financing facility, we aim to unlock more opportunities and capital for these impactful ventures, catering to their diverse needs across various markets.”

Investing in Promising Ventures

Marking a significant milestone, Village Capital announced its initial investments in two startups:

Bena Care: A Kenyan company delivering affordable clinical and supportive care to patients with life-limiting illnesses in their homes.

Mighty Finance: A Zambian fintech startup dedicated to providing accessible capital primarily to women-led businesses.

Each startup received $75,000, bringing the initial investment to $150,000.

Joyce Kibe, Head of Corporate Affairs, Brand and Marketing at Standard Chartered, emphasized the program’s significance saying:

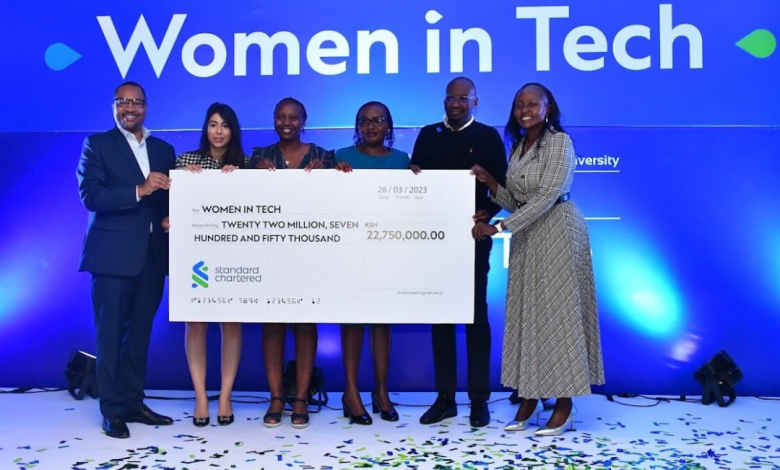

“This partnership builds upon our successful Women in Tech program, which has equipped over 70 women-led businesses with valuable tools and support. We believe investing in women entrepreneurs fosters stronger, more resilient economies and addresses crucial needs often overlooked in the startup ecosystem.”

Standard Chartered’s Women in Tech program has empowered 64 women-led businesses through six cohorts, awarding grants totalling $7 million to 32 participants.

This new partnership signifies the bank’s and Village Capital’s unwavering commitment to promoting diversity, equity, and inclusion in the impact investing sphere.

Related Articles

Register Now

Empower Africa Times Newsletter

Share :

“We are delighted to partner with ISA to support the development of solar energy in Africa,” said Alain Ebobissé, CEO of Africa50. “This partnership will help to accelerate the deployment of solar energy in Africa and improve the lives of millions of Africans,” he added.

You may also like...

Sabou Capital, New SME Fund Unveiled to Invest $350K–$1.5M in 25 African Startups

Surayyah Ahmad, a seasoned entrepreneur and co-founder of two previous ventures, has launched Sabou Capital, a new investment fund aimed at closing funding gaps for small and medium-sized enterprises (SMEs) in West and Central Africa.

Inspired Evolution Invests $20 Million in Cold Solutions East Africa

Inspired Evolution, through its Evolution III Fund, has invested $20 million in Cold Solutions East Africa Holdings (CSEAHL), a company that builds and operates temperature-controlled warehouses and logistics facilities across East Africa.

Mirova Invests $19 Million in Kenya’s Cold Solutions Kiambu to Scale Climate-Smart Cold Chain in East Africa

Mirova has committed $19 million to Cold Solutions Kiambu SEZ Limited, supporting the expansion of climate-aligned temperature-controlled logistics infrastructure in Kenya.