New Investments

Adenia Partners Secures $470 Million for Largest Africa-Focused Fund

Adenia Partners, a Mauritius-based private equity firm specializing in African investments, has announced the successful closing of its fifth and largest Africa-focused fund, the Adenia Africa Fund, at $470 million.

This fund surpasses Adenia’s previous fundraising efforts and attracted investments from both existing and new partners, including Norfund AS, the US International Development Finance Corporation, and Canada’s Findev Inc.

Notably, the Public Investment Corp. Ltd., a prominent African fund manager, and pension funds from Ghana and Kenya also participated.

Adenia surpassed its initial target of $400 million, thanks in part to long-standing investors like the European Investment Bank and the World Bank’s International Finance Corporation, who doubled their commitments, contributing a total of $300 million.

“We’re excited by the strong investor confidence in this fund,” said Christophe Scalbert, Head of Investor Relations at Adenia.

“This allows us to increase our average investment size per company to $40 million.”

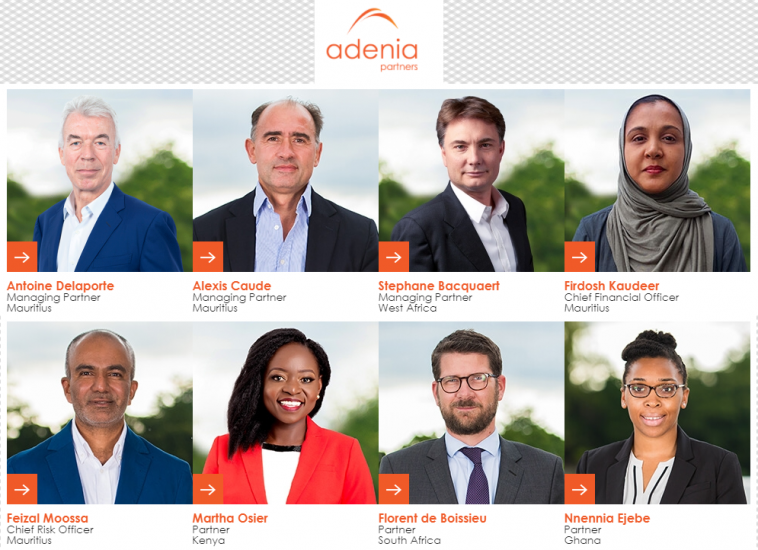

Adenia focuses on acquiring controlling stakes (51% to 100%) in medium-sized businesses across various sectors, including fintech, telecommunications, and healthcare. This approach, according to Managing Director Alexis Caude, allows them to “be in the driver’s seat” and influence exit strategies.

“Our goal is to deliver net returns exceeding 15% in hard currency for our investors,” explained Caude. “Taking control allows us to manage exit timing more effectively.”

Founded in 2002, Adenia boasts over two decades of experience in Africa.

With headquarters in Mauritius, they operate in seven African countries with a team of 21 investment professionals. The firm recently opened an office in Nigeria, a rapidly growing economy despite its investment challenges.

Currently, Adenia is collaborating with Air Liquide SA on a deal involving operations across 12 African nations.

The firm faces competition from other established investors like Alterra Capital Partners and Helios Investment Partners.

Related Articles

Register Now

Empower Africa Times Newsletter

Share :

“We are delighted to partner with ISA to support the development of solar energy in Africa,” said Alain Ebobissé, CEO of Africa50. “This partnership will help to accelerate the deployment of solar energy in Africa and improve the lives of millions of Africans,” he added.

You may also like...

Mawingu Gets $20 Million Funding from PRIF II to Boost Rural Internet Expansion in Africa

Mawingu, a telecommunications firm specializing in delivering internet connectivity across rural and peri-urban East Africa, has secured a US$20 million investment from the Pembani Remgro Infrastructure Fund II (PRIF II).

Nigerian Fintech Moniepoint Becomes Africa’s 8th Unicorn After Securing $110 Million Series C Funding

British private equity firm Development Partners International (DPI) has led a $110 million investment in Nigerian fintech Moniepoint, elevating the company to unicorn status.

Africa Go Green Fund and ARCH Invest $18 Million in Uganda Cold Storage Facility

The Africa Go Green Fund (AGG), overseen by Cygnum Capital, has approved an $18 million senior debt facility for Cold Solutions Kazi Limited.