New Investments

Kenyan fintech Zanifu raises $11.2 million to scale its inventory financing offering

The funding round was led by Beyond Capital Ventures and Variant Investments.

The round also saw participation from other investors, including Founders Factory Africa, AAIC Investment, Google Black Founders Fund, and existing investor Launch Africa.

This brings the total debt-equity funding raised by the startup to $12.7 million.

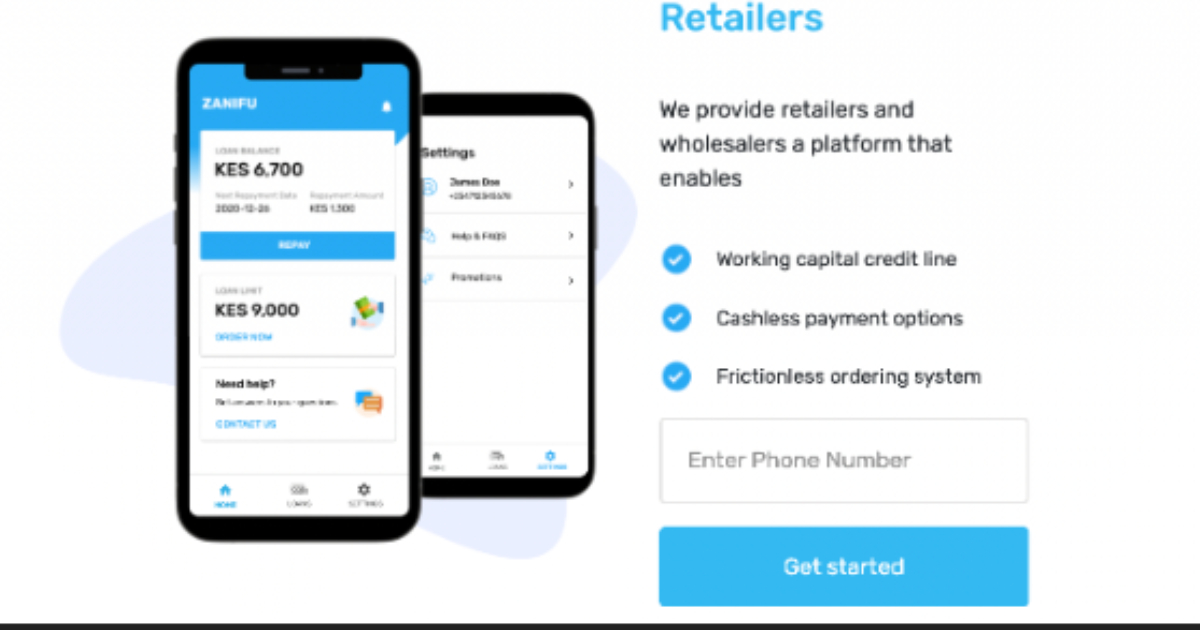

Zanifu’s inventory financing product provides MSMEs with access to working capital to purchase inventory.

The company uses a proprietary credit scoring model to assess the risk of each borrower and offers loans with terms of up to 12 months.

The new funding will be used to scale Zanifu’s operations in Kenya and to launch new products and services.

The company also plans to use the funding to hire more staff and build its technology platform.

Zanifu is on a mission to provide affordable and accessible inventory financing to MSMEs in Kenya.

The startup’s inventory financing product has already helped over 1,000 MSMEs in Kenya to grow their businesses.

Zanifu’s latest investment is a positive development for the fintech sector in Kenya and will help to promote financial inclusion and to support the growth of MSMEs.

Related Articles

Register Now

Empower Africa Times Newsletter

Share :

“We are delighted to partner with ISA to support the development of solar energy in Africa,” said Alain Ebobissé, CEO of Africa50. “This partnership will help to accelerate the deployment of solar energy in Africa and improve the lives of millions of Africans,” he added.

You may also like...

Kenya’s Octavia Carbon Secures $5 Million in Seed Funding to Advance Carbon Removal from Air

Kenyan startup Octavia Carbon has successfully raised $5 million in seed funding to advance its innovative direct air capture (DAC) technology, which aims to remove carbon dioxide (CO2) from the atmosphere using geothermal resources, particularly waste heat.

Nigerian Fintech Moniepoint Becomes Africa’s 8th Unicorn After Securing $110 Million Series C Funding

British private equity firm Development Partners International (DPI) has led a $110 million investment in Nigerian fintech Moniepoint, elevating the company to unicorn status.

Octopus Energy Launches $250M Clean Energy Fund to Accelerate Africa’s Green Transition

Octopus Energy Generation, the clean energy investment arm of Octopus Energy, has unveiled a new initiative aimed at catalyzing renewable energy development across Africa.